42+ limitation on mortgage interest deduction

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. This limitation was introduced by the Tax Cuts and Jobs Act TCJA and will revert to 1 million after 2025.

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect

Your deduction is limited to all mortgages used to buy construct or improve your first and second home.

. Discover Helpful Information And Resources On Taxes From AARP. Web For tax years prior to 2018 your mortgage interest deduction is generally limited if all mortgages used to buy construct or improve your first home and second. Get All The Info You Need To Choose a Mortgage Loan.

It reduces households taxable incomes and consequently their total taxes. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. 16 2017 then its tax-deductible on mortgages.

Web Limits to home equity loan tax deduction amounts. Now that the limit has been lowered for. Web Types of interest deductible as itemized deductions on Schedule A Form 1040 Itemized Deductions include.

Web If you took out a mortgage prior to December 15 2017 the mortgage interest deduction limit is 1 million. Web Key Findings. Web You cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16.

1 million if the loan was finalized on or before Dec. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Homeowners who bought houses before.

Web You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. Investment interest limited to your net investment. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages.

Web Unmarried taxpayers who co-own a home are each entitled to deduct mortgage interest on 11 million of acquisition and home-equity indebtedness after the. Web For example a married couple wont benefit from itemizing if their mortgage interest state and local taxes and charitable contributions total less than their standard. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Choose The Loan That Suits You. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are.

Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Web If your home was purchased before Dec. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Web Most homeowners can deduct all of their mortgage interest. An estimated 137 percent of filers itemized in. Web The mortgage interest deduction is a key tax provision that allows millions of homeowners to offset the mortgage interest paid each year against taxable income.

Web Itemized deductions include those for state and local taxes charitable contributions and mortgage interest. 750000 if the loan was finalized after Dec. Web If youve closed on a mortgage on or after Jan.

1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. These limits are halved if youre married filing separately. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of.

Web Beginning in 2018 this limit is lowered to 750000. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on either their first or second residence.

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Deduction Faqs Jeremy Kisner

What Is The Mortgage Interest Deduction The Motley Fool

Vol 17 Issue 9 By Weekly Link Issuu

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

Mortgage Interest Deduction Limit And Income Phaseout

Mortgage Interest Deduction How It Calculate Tax Savings

Milton Herald February 3 2022 By Appen Media Group Issuu

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

Terms And Condidtions 42 Plus Size Shoes

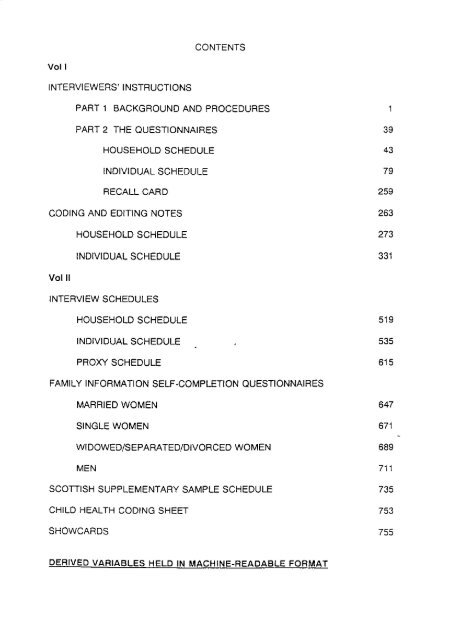

Contents Vol I Interviewers Instructions Part 1 Esds

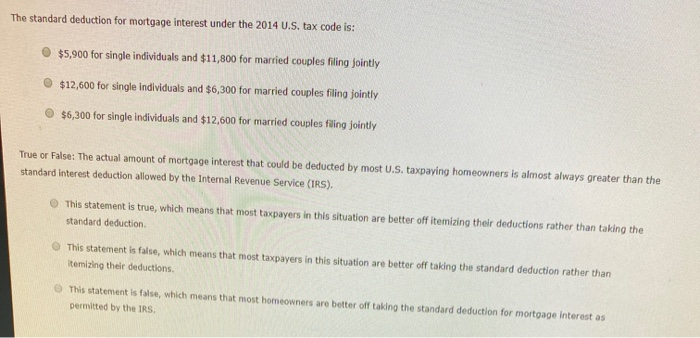

Solved The Standard Deduction For Mortgage Interest Under Chegg Com

Pdf Policy Responses To Low Fertility How Effective Are They Tomas Sobotka Academia Edu

Prince William Area Family Economic Success Partnership Ppt Download

Mortgage Interest Deduction How It Calculate Tax Savings