Calculate tax on item

Profit Before Tax Definition. Intangible assets can be an important item on the balance sheet for many businesses.

Discount Price Digital Distance Learning Lesson Boom Cards Video Video Lesson Interactive Lessons Student Reflection

The tax imposed on the import of goods is known as the import duty.

. Whether you sell or rent goods or charge admission to events you must collect sales tax and send the money to the Florida Department of Revenue. Every item sold in Florida is subject to the Florida Sales and Use tax. Youd multiply 2795 by 08 giving you a sales tax amount of 224.

From there it can determine the corresponding sales tax rate by accessing AvaTax our innovative cloud-based sales tax calculation product. Add 100 percent to the sales tax rate. Tax Preference Item.

There is a sales tax holiday. State and local governments across the United States use a sales tax to pay for things like roads healthcare and other government services. GST is an Indirect Tax which has replaced many Indirect Taxes in India.

So lets say youre buying something that costs 2795 with a local tax rate of 8. The Goods and Service Tax Act was passed in the Parliament on 29th March 2017. Section 197 of the IRS tax code lists and defines the following assets as intangibles with an indefinite life assuming you created the assets as.

To know more about how item 12 of IR56B is to be completed please study the following 3 examples IR56EFG carries the same format. Add that amount to the price of the item to find your total cost with tax. While most taxable products are subject to the combined sales tax rate some items are taxed differently at state and local levels.

Example 1 For 1 April 2021 to 31 March 2022 company X rented a flat at Flat A 3F Justice Court No1 Justice Road Hong Kong and provided it to Ms Anna Chan the employee as her place of residence. Assessable Value Rs1000-Basic Customs Duty Rs. A temporary difference is an item of income or expense that is allowed for either income tax or GAAP purposes in one year but not allowed under the other accounting system until a later year.

Profit before tax PBT is a line item in a companys income statement that measures profits earned after accounting for operating expenses like COGS SGA Depreciation Amortization etc non-operating expenses Non-operating Expenses Non operating expenses are those payments which have no relation with the principal business activities. The iPhone and the seventh Harry Potter novel have different life cycles. In all tax rates in California range from 75 percent.

While it could be considered a collectors item its function is effectively useless after years of new devices and software updates. What Are Intangible Assets. The combined tax rate is the total sales tax rate of the jurisdiction for the address you submitted.

The jurisdiction breakdown shows the different sales tax rates making up the combined rate. If you decide to complete and sign your tax return most people finish in just minutes our qualified accountants check your return and look for suggestions about further deductions or adjustments that can boost your. The item is exempt from sales tax.

The Tax Return Calculator is a free part of the Etax online tax return a paid tax agent serviceThe calculator provides an instant estimate of your tax refund or payable. If you are a sales tax collector you are entitled to a Florida Sales and Use Tax Collection. The sales tax formula is simply the sales tax percentage multiplied by the price of the item.

It can calculate the gross price based on the net price and the tax rate or work the other way around as a reverse sales tax calculatorThe sales tax system in the United States is somewhat complicated as the rate is different depending on the state and. The assessable value of an imported item is Rs1000-Basic Customs Duty 10 Integrated Tax Rate 18 The taxes will be calculated as follows. While filing for his income tax returns his accountant informed him that he is eligible for tax exemption worth 20000 and deductions worth 25000.

When you add it to the tax rate you get a total percentage that represents the pre-tax price plus the tax. Tax preference items include private-activity municipal-bond interest. Again there may be more than one district tax applied to the sales tax in a given area.

John joined a bank recently where he earns a gross salary of 200000 annually. Then multiply the resulting number by the list price of an item to figure out the sales tax on that item. The 2007 iPhones product life cycle immediately shortened with the release of the 2008 iPhone 3G.

The Act came into effect on 1st July 2017. Straight-line depreciation is the usual method used to calculate amortization. Thus the income or expense item will eventually be allowed for both GAAP and income tax purposes with the only difference being the timing of the item.

This online sales tax calculator solves multiple problems around the tax imposed on the sale of goods and services. Many states provide a day or weekend where consumers can shop without paying sales tax. Generally your state will designate certain items that are tax free.

District tax rates range from 01 to 1 percent and are added to the state sales tax rate as a surtax. Whereas the tax imposed on the export of goods is known as the export duty. This level of accuracy is important when determining sales tax rates.

So if the sales tax in. Let us take the example of John to understand the calculation for the effective tax rate. Do not collect tax on tax-free items during a sales tax holiday.

A type of income normally tax-free that may trigger the alternative minimum tax AMT for taxpayers. Sales tax applies to most consumer product purchases and exists in most states. Some states exempt certain items from sales tax.

When you enter the street address the calculator uses geolocation to pinpoint the exact tax jurisdiction. Goods Services Tax Law in India is a comprehensive multi-stage destination-based tax that is levied on every value addition. The 100 percent represents the whole entire pre-tax price of the item in question.

Product Cost Price Profit Calculator Ebay Etsy Mercari Etsy Excel Spreadsheets Price Calculator Spreadsheet Template

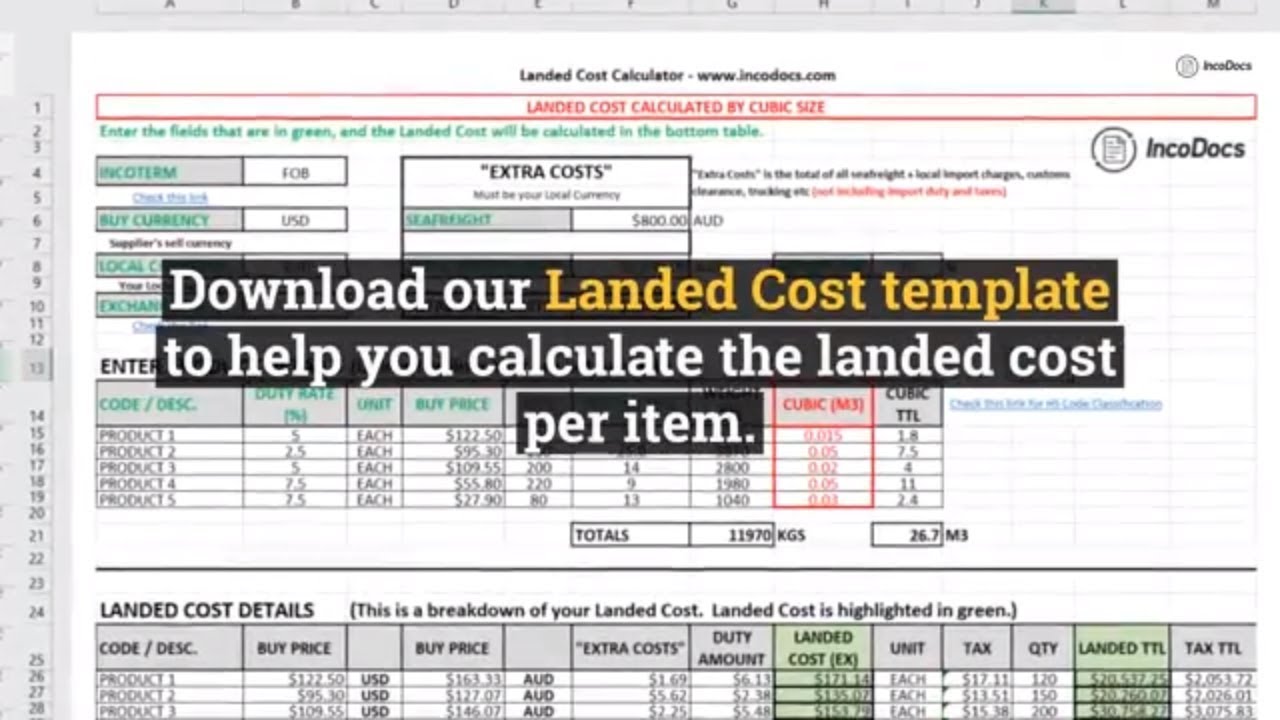

Calculate Landed Cost Excel Template For Import Export Inc Freight Customs Duty And Taxes Excel Templates Excel Verb Worksheets

Calculate Sales Tax Worksheet Education Com Money Math Worksheets Consumer Math Holiday Math Worksheets

Sales Tax Anchor Chart Math Anchor Charts Anchor Charts 7th Grade Math

Cost Of Goods Sold Spreadsheet Calculate Cogs For Handmade Sellers Cost Of Goods Sold Cost Of Goods Spreadsheet

Product Pricing Calculator Handmade Item Pricing Worksheet Etsy Business Template Pricing Calculator Product Pricing Worksheet

End Of Year Inventory Template Calculate Beginning And Ending Inventory Excel Worksheet Excel Spreadsheets Templates Pricing Templates Types Of Taxes

Paying The Tax Students Work In Small Groups On This Activity To Determine The Type Of Tax Described In The Sit Financial Literacy Types Of Taxes Student Work

Calculate Your Way To Success

Pin On Airbnb

Pin On Essentially Essential

What To Do When The Irs Is After You Irs Personal Finance Organization Personal Finance

Cost Of Goods Sold Spreadsheet Calculate Cogs For Handmade Etsy Cost Of Goods Sold Pricing Templates Cost Of Goods

Calculating Tax Percent Digital Puzzle

Product Cost Price Profit Calculator Ebay Etsy Mercari Etsy Pricing Calculator Price Calculator Google Sheets

Etsy Pricing Profit And Fees Calculator For Digital Item Etsy Pricing Templates Craft Pricing Calculator Small Business Tools

Use This Sales Tax Calculator To Figure Shipping At A Rate Of 12 Free To Download And Print Tax Printables Sales Tax Tax